When lockdown first kicked in at the start of last year, we packed up our office, watered the plants, emptied the fridges & went home. I think we lost about an hour that day before we were back up & running as fortunately the software we use, Swiftcase is cloud based. It helped that about a third of our workforce have been home-based for the last two decades, with engineers dotted around the country, so we’re used to remote working & communications. So how did we go from merely surviving to thriving during lockdown?

We’re a well oiled machine, a tight team, so we found that our biggest challenges were not internal but getting access to garages, recovery and salvage agents facilities, so it presented us with an ideal opportunity to propose our alternative solution, desk-top or virtual reports.

We have a diverse client base from car rental companies & solicitors to insurance companies, police forces & motor dealerships, some are incredibly high tech & cutting edge, whilst others more pen & quill “if it ain’t broke don’t fix it” brigade.

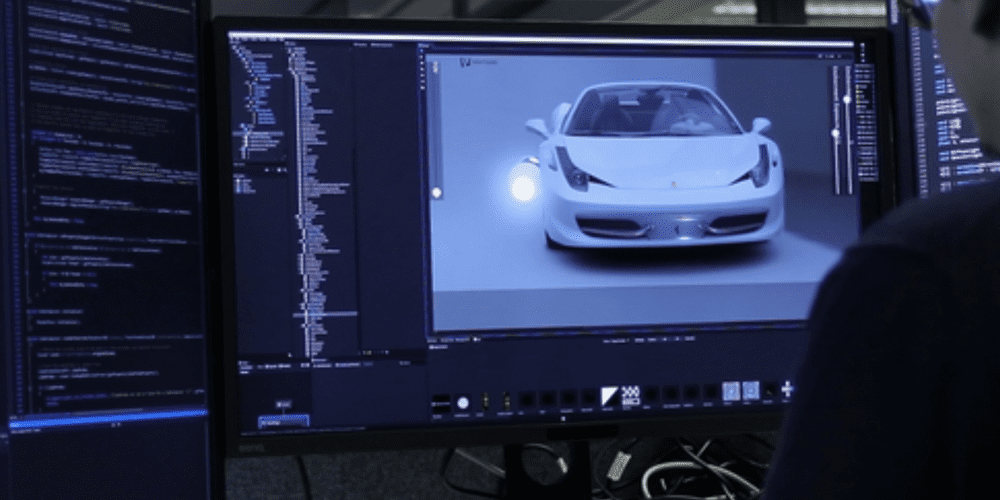

Since 2000 we’ve been compiling desk-top reports for many clients & indeed during lockdown we noted a tangible increase in the proportion of instructions coming from the more tech savvy sector. Not wanting to be left behind the more traditional clients needed a solution, so they took the first tentative steps to desk-top reporting & found that actually it’s more or less the same product as they’d been used to, but completed much quicker, cheaper & a lot better for the environment.

There were concerns; would the courts, solicitors, insurers accept them? Well the vast majority of major insurers utilise desk-top report for the bulk of their claims. What if the images missed something? It’s in the garage’s interest to note every nut & bolt of damage, there would be no point in hiding anything, they want their estimate to be as high as possible. Surely a physical examination is better than photos? When there’s complicated damage, yes, but for the other 99% of cases, a dent in a door, a scraped wing, a damaged bumper, there’s nothing to gain from a physical inspection if we have a set of HD comprehensive images. With desk-top reports turned around the same day, key-to-key times are reduced thus saving on the global cost of a claim.

So the lesson; be aware of what technology is available & ensure that your client communication is brilliant on both a human front and that your systems communicate intelligently together.

Like to chat about our bespoke automotive solutions, please click here.