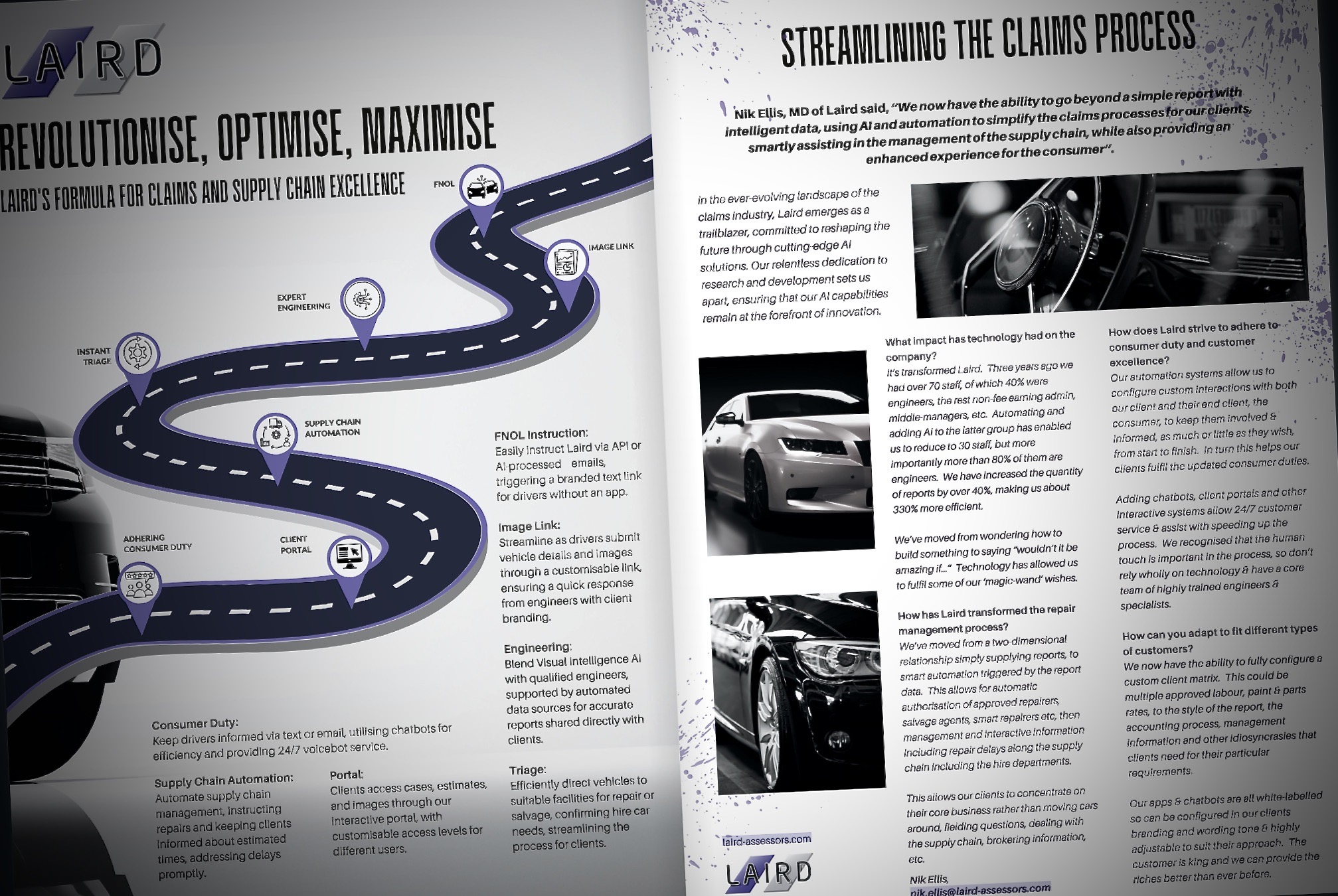

In the ever-evolving landscape of the accident repair industry, Laird emerges as a trailblazer, committed to reshaping the future through cutting edge AI solutions & streamlining the claims process.

Nik Ellis said, “We now have the ability to go beyond a simple report with intelligent data, using AI and automation to simplify the claims processes for our clients, smartly assisting in the management of the supply chain, while also providing an enhanced experience for the consumer”.

What impact has technology had on the company?

It’s transformed Laird. Three years ago we had over 70 staff, of which 40% were engineers, the rest non-fee earning admin, middle-managers, etc. Automating and adding AI to the latter group has enabled us to reduce to 30 staff, but more importantly more than 80% of them are engineers. We have increased the quantity of reports by over 40%, making us about 330% more efficient.

We’ve moved from wondering how to build something to saying “wouldn’t it be amazing if…” Technology has allowed us to fulfil some of our ‘magic-wand’ wishes.

How has Laird transformed the repair management process?

We’ve moved from a two-dimensional relationship simply supplying reports, to smart automation triggered by the report data. This allows for automatic authorisation of approved repairers, salvage agents, smart repairers etc, then management and interactive information including repair delays along the supply chain including the hire departments.

This allows our clients to concentrate on their core business rather than moving cars around, fielding questions, dealing with the supply chain, brokering information, etc.

How does Laird strive to adhere to consumer duty and customer excellence?

Our automation systems allow us to configure custom interactions with both our client and their end client, the consumer, to keep them involved & informed, as much or little as they wish, from start to finish. In turn this helps our clients fulfil the updated consumer duties.

Adding chatbots, client portals and other interactive systems allow 24/7 customer service & assist with speeding up the process. We recognised that the human touch is important in the process, so don’t rely wholly on technology & have a core team of highly trained engineers & specialists.

How can you adapt to fit different types of customers?

We now have the ability to fully configure a custom client matrix. This could be multiple approved labour, paint & parts rates, to the style of the report, the accounting process, management information and other idiosyncrasies that clients need for their particular requirements.

Our apps & chatbots are all white-labelled so can be configured in our clients branding and wording tone & highly adjustable to suit their approach.

The customer is king and we can provide riches better than ever before.

Reproduced with kind permission from Modern Insurance Magazine